How often do you worry about your cash flow?

How often do you sit down to do a cash flow forecast?

Yup. That’s what I thought.

Most of us only sit down and work out what’s happening with our cash flow when we’re worried that we’re not going to have enough money for some reason. Or when we have to apply for a grant or a loan.

But what if I asked you a different question?

How often do you worry about your cash flow?

Now maybe you never worry about cash flow at all. You might be one of those people who always keep a healthy balance in your business bank account. Or you have so much coming in that you only have to worry about how to count all the money.

When we do need to forecast cash flow

For the rest of us, there are certain times when cash flow is our biggest concern. Worrying about cash flow can take up quite a bit of our mental bandwidth. Especially if you’re thinking about investing in something new, like extra marketing or doing one of those great programmes about building a products business. Or if you’re just waiting for someone to pay you, so you can pay everyone else.

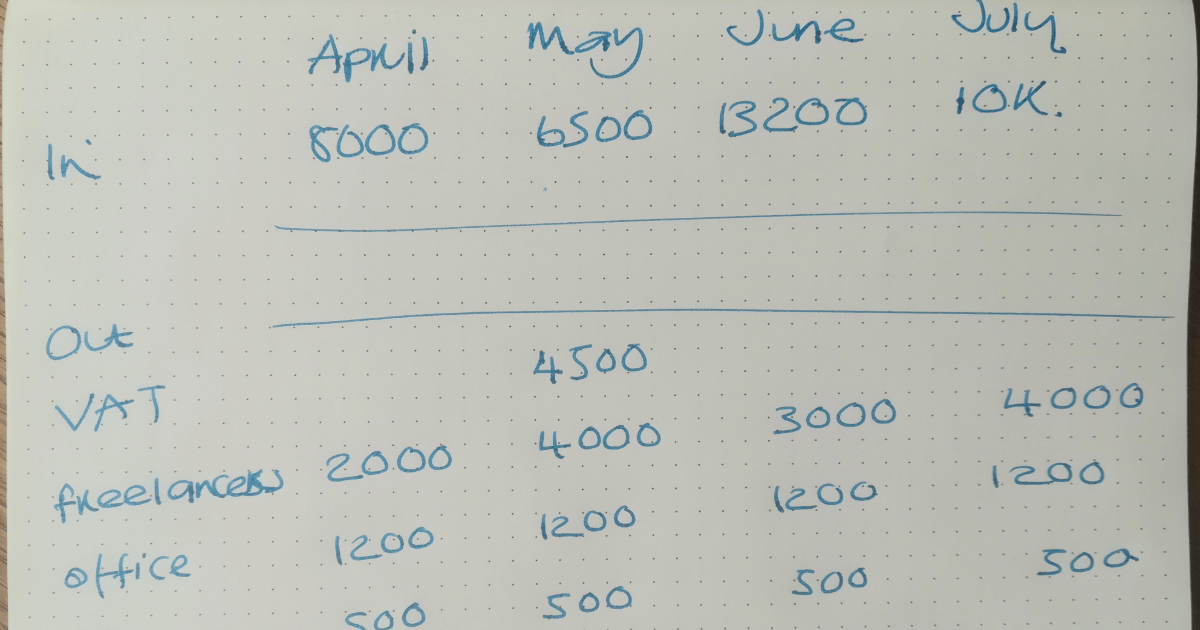

Normally we sit down with a piece of paper and do a quick sketch of our money situation. You know, you’ve done it.

The problem with the quick sketch approach is that it’s too easy to leave something out. Or put something in. And then forget whether you included VAT…oh, and by the way, how much do I need to pay HMRC next time? The pen-and-paper approach is not always accurate and tends to leave you with lingering doubts.

I know this because, of course, I’ve done all of this myself. The 4 am cold sweat about a bill I need to pay, the “quick” working out in my notepad that’s never quite right…I’ve definitely been there.

And I know this because I talk to clients about cash flow all the time. And what I found was that hardly anyone does a cash flow plan because it’s just too bamboozling. You don’t know what to include, what’s supposed to go in, what gets left out? Do we include depreciation? Loan repayments? Interest?* What about that quote we did last week, where they said yes, but there’s no contract signed yet?**

What if there was a simpler way to forecast cash flow?

What if we could all sit down for a half hour with a cup of coffee and our favourite Spotify playlist, pop some numbers into a spreadsheet and then be pretty certain of whether our business is healthy or not.

And that instead of scratching your head or forgetting those important payments going out, you could just know how things are going.

And then sleep soundly through the night.

Here’s what I made

I looked around for a cash flow forecast tool to help clients to do this properly. Unfortunately, the free ones either made it even more confusing or just didn’t work properly. And the expensive ones which link to your accounts software were too much for small businesses like ours. And there is an irony in paying out £35 per month (+VAT) extra to help you feel secure about your cash flow.

Because I couldn’t find anything that was, to paraphrase William Morris, both beautiful and useful. All the cashflow forecast tools I looked at were confusing, misleading or just too ugly to use. Some of them didn’t even add up correctly.

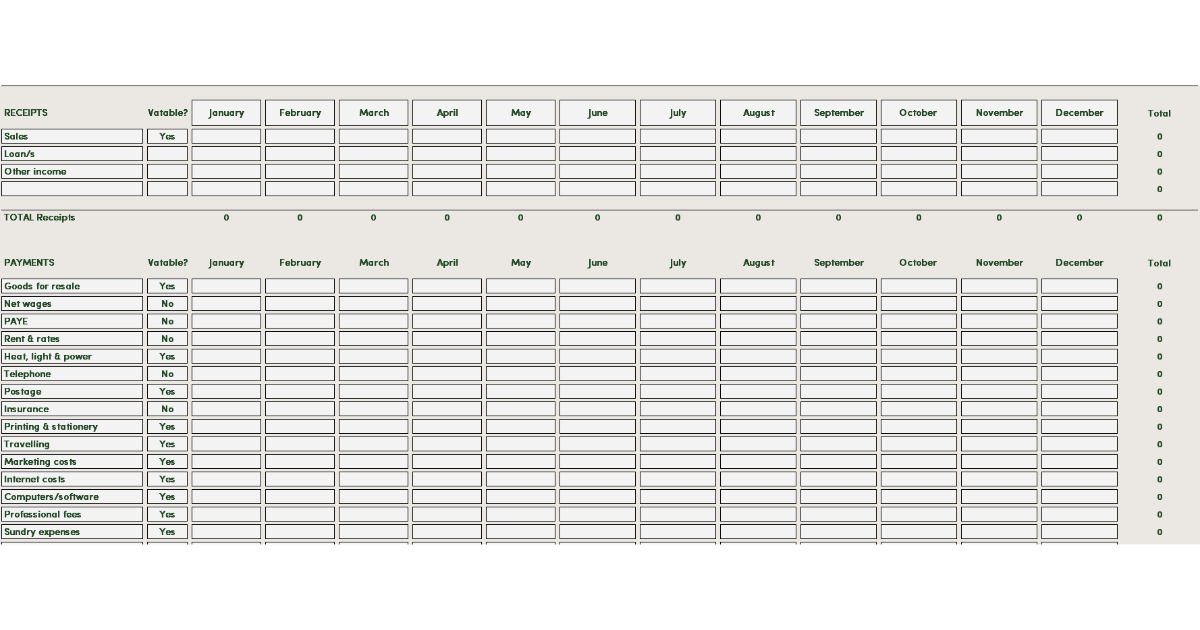

So I made one myself, based on what a small business that happens to be VAT registered would need to take into account. And I knew that most business owners have better things to do than mess about with confusing spreadsheets, so I made it very simple to use. And then I got an Excel wizard to check it all out and make it beautiful. I was pretty pleased with it.

I put it on sale because I thought some people might want one too.

It’s pretty cool. It does all the adding up for you, takes the VAT into account in the right way, and tells you what your next VAT payment is likely to be. And the effect that this will have on your cash flow.

I tested it on myself. And then I got some clients to test it. And I tweaked it a bit. And I got a spreadsheet expert to check it and make it beautiful.

And now I’m offering it to you. For a small fee.

So if you’ve ever found yourself worrying about cash flow or trying to work it out on a piece of paper and thought… “I’ve got better things to do with my time. I wish there were a simple, beautiful spreadsheet I could use for this that would work this out for me…” here you go.

Enjoy it. It’s a work of art.

Oh, yes, those cash flow conundrums

* The correct answer, by the way, is – depreciation is something made up by accountants and isn’t real money, but loan repayments and interest are. So, depreciation doesn’t go in, but loan repayments and interest do. Depreciation and interest do go on your profit and loss. Repayments only go on the balance sheet (and in the cash flow). How is any normal person supposed to remember all this and run a business?

** Up to you on this one, but I’d put this in the cash flow if you’re more than 50% certain they meant yes.