What are growth shares?

“What are growth shares?” is usually the question when I suggest that a business owner might want to think about growth shares. Or, people ask, “How do growth shares work?”

If you’re just at the beginning of thinking about all this shares stuff, you might want to start with my general article about giving shares in your business to other people.

For a plain English explanation of how growth shares work in practice, based on real-life examples of where I’ve advised business owner clients to use growth shares to give equity to staff, read on.

What are growth shares?

Growth shares are a way of giving someone else shares in your company, but they only get the benefits of the shares in the part of the company which grows after they get the shares. Hence, the term growth shares.

You might use growth shares for:

- giving equity to all your employees under a growth share scheme

- incentivising senior members of staff, especially when you want them to focus on growing the company

- a low risk way to start transferring shares as part of your succession plan

An example of growth shares and how they work

It’s easiest to show how growth shares work with a real-world example. This is a true story of Esmerald and how growth shares worked for her. Obviously, I’ve changed some of the details here to keep her identity secret.

How do growth shares work in practice?

My client, let’s call her Esmeralda, has spent the last 10 years building up a consultancy practice. The company was now turning over 2.3m, and she had 20 employees.

Esmeralda is now 57 (a great age btw) and wants to slow down a bit after working ridiculously hard for the past 10 years. She is also looking ahead and thinking that she might want to retire in 10 years time and sell the company.

She’s offered a senior job to someone who was currently working for a competitor. Let’s call him Alex. Alex is really good and quite a bit younger than Esmeralda. She knows that he is currently earning 85k a year.

Esmeralda wants Alex to come and work at her company, but she doesn’t want to pay 85k. Partly because it’s a lot of money, but mostly because the other senior people who work for her are only getting 60k, and she doesn’t want to give everyone pay rises.

![]()

Esmeralda has already thought things through and was considering giving Alex some shares as a way of encouraging him to come and work at her company. She isn’t sure about the best way to do this, so she booked a couple of hours with me to talk it over.

She wants to give some shares to Alex, and four other senior staff. But she’s aware that if she just gives them shares in her company, they’d have to pay tax on the shares because her company was already worth serious money. Giving them a massive tax bill did not seem like a good idea. And she owned up in our meeting to resenting giving them shares in the company she’s worked so hard to build and taken all the risks on.

Why I suggested growth shares to Esmeralda

This is where I suggested that Esmeralda thought about growth shares. This is how I put it to her.

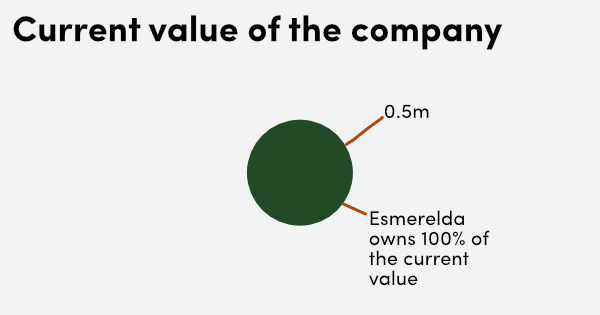

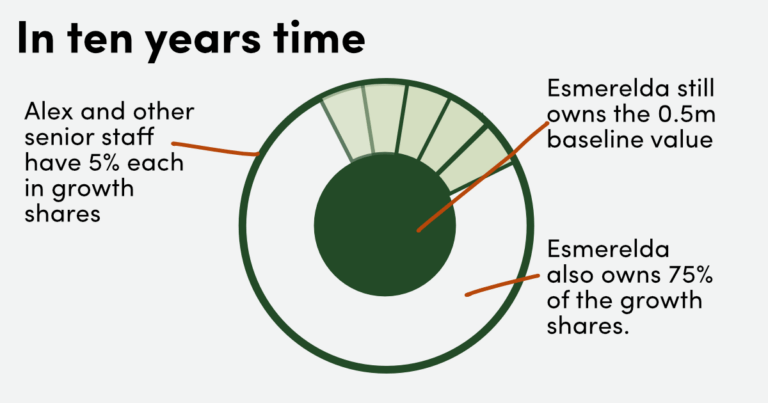

“Your company has profits of about 120k. So, it’s probably worth at least half a million if you sold it today. When Alex comes in and works hard, along with the other folk, you could probably be worth four or five times that in 10 years.

“If you give the others growth shares now and then sell the company in 10 years, you get to keep all of that half a million. Plus most of the rest of the growth. The others could each have 5% of the growth shares. Then, if you sold for 3m, they’d get 100k each, and you’d get the half-million it’s worth now, plus 75% of the growth, or 2.3m in total. Which would be a great bonus for them, plus a good retirement fund for you.”

Why would you want to use growth shares?

I think you get the idea now. Growth shares are a great way of giving shares to a key employee but keeping the existing value of the company for yourself. The employee has a great incentive to help grow the company because they get a share of the increase in value when it’s sold.

Don’t forget that you will want to give yourself growth shares as well as give them to employees. In Esmerelda’s example, most of the extra value in ten years time was in the growth of the company, and if Esmerelda sold the company at that point, her big win would be the 2.3m that came from the company getting bigger.

Growth shares is a way of sharing out that increase in the value of the company, not just giving it away to your employees.

Even if your company is not likely to grow as much as this, there are other reasons why growth shares are a good idea. Let’s look at some other examples.

Staff often like dividends from growth shares

Growth shares also allow you to give dividends to these staff as a top-up to their salary. In Alex’s case, in the example above, it is to compensate for a lower salary than he was getting before. Even though these dividends might be quite small, it still keeps staff thinking about how they can increase profit levels because they’ll get a share of those profit levels now and when the company is sold.

Paying people in part through dividends can be very useful. Senior staff often appreciate this because:

- It feels more like they really do own part of the company when they get dividends from the growth shares

- They pay slightly less income tax on their dividends than if they’re just getting a salary, although the difference here is less than it used to be used to be in the UK

- The growth share dividends are usually paid out once a year, so it feels both like a bonus and it’s related to the performance of the company

Growth shares as part of your succession planning

Growth shares are also really useful if, like Esmeralda, you’re thinking about your exit. She wasn’t sure if she wanted to sell her company to one of her competitors or a bigger company (a trade sale) or if she’d like to sell the company to some of the staff (a management buyout).

She didn’t need to decide that right now, but giving the growth shares to the senior managers meant that she would have started that process of transferring some of the ownership to other people in the company while keeping her options open. This can be highly beneficial for the founder because it gets your senior team thinking like a senior team. And it can be good for the staff because if you do decide to go for a management buy out in the future, they will already have some shares in the company and there are less to transfer. Which limits the amount they need to borrow and the tax to pay on a buy out.

Advantages of growth shares

Growth shares are great when your business has been going for a while and has some profits because it avoids HMRC sending a massive bill to your employees because you were nice enough to give them some shares.

Growth shares are also good for a company that already has some decent profits because you get to keep what you’ve already created while rewarding and incentivising staff to make the company grow bigger.

People often compare growth shares with the EMI share option scheme, which has different tax advantages for staff. Growth shares are often a better option than the EMI share option scheme because you can also give staff a dividend. Staff often appreciate this tax benefit on growth share dividends now, rather than than a possible better tax advantage further down the line

I think this is good because it gets them starting to think like co-owners of the company, and they get a boost when it’s doing well. You can make the dividend optional or only to be paid under certain conditions to protect yourself. For example, you might get the first 50k of dividends, which can be important if you have a year when the profit isn’t so high. Or if profits are good, you get any extra profits over, say 200k, which is handy when you want to take out more of the money yourself to pay for your new kitchen.

Growth share hurdles

You can set conditions or hurdles for when any dividends are to be paid to the staff team. This means that the staff with growth shares only get paid extra money if the company has actually grown. If there’s no growth, there’s no value in the growth shares.

You can also add in other conditions on the growth shares. These might be:

- The person still works for the company

- The company has achieved a certain target, eg, we got to 5m turnover or 1m net profits.

- They have achieved a set target

Growth shares and sales targets

One of my clients told me about how their company was now in a high growth season. He knew that in the next two years there were going to be a lot of new opportunities. He was ready to go for it. And he wanted to incentivise the sales team to go for it as well. After a long chat about growth shares vs a simple profit share, he decided to give everyone in the sales team growth shares. But they only got to keep the growth shares and get growth share dividends if they met their sales targets.

This worked well for my client, and his sales team did indeed step up and bring in a lot of new business. Bear in mind, though, that this might not be the right solution for your company – this was a good option for him at that point in the company’s growth.

Where growth shares are not such a good idea

Growth shares are not needed unless your company has a real value already. If you’re just starting up, you don’t need growth shares. Or if you’ve been recycling most of the profit back into growing the company, and there’s not much left on the profit and loss account, growth shares aren’t such a good idea.

You probably wouldn’t give growth shares if you were giving shares to your wife, husband or partner unless you happen to be married to one of the key staff you want to incentivise.

Other ways of using shares as an employee incentive

Growth shares are not the only way to issue shares. You should also think about:

- Just give non-voting B-class shares to an employee and protect yourself with a shareholders agreement. This is a simpler way to do it and works well for smaller businesses which don’t have big valuations. Or where you want to avoid big legal bills.

- Setting up a profit-sharing scheme for key staff or even all the staff. This is much simpler and doesn’t involve letting go of any equity. I’ve advised quite a few companies not to get into all the complexity of issuing shares and just to set up a profit-sharing scheme instead.

- The EMI share options scheme is worth thinking about as well, but it works in a completely different way and is only worthwhile for companies with serious large-scale growth ambitions.

Would you like some help with this?

I really enjoy talking about these issues with people and helping them to work out a plan of action. Giving away a chunk of your business is the kind of thing you only do once or twice in your life, and it’s really important that you understand exactly how to do this properly, for you and for the people you’re giving shares to.

You can book a two-hour strategy session with me, to talk about the best way to give shares in your company to someone else. We’ll cover things like:

- The best mechanism for doing this, whether that’s using growth shares or a different way

- Work out how many shares you should give to someone

- How to protect yourself and the business.

- We can also work on your negotiation tactics, so you know exactly how to move forward.

Here’s how to book a two-hour session to talk all of this through, and save yourself a fortune in legal fees.

Book time with Julia Chanteray

Other helpful articles about how to give shares to others

You might want to also read these articles about shares and equity:

How to give away shares in your business (main article, so start here)

Getting investment into your business

The difference between share options and shares for small businesses

The EMI scheme for giving shares to employees

The big danger in chasing investment

The advantages and disadvantages of a share issue

Photo credits to rawpixel and Aaron Huber on Unsplash; Liz Finlayson from Vervate