What happens to my limited company if I die?

None of my clients have ever asked me, “What happens to my limited company if I die?” But they should.

Part of my role as a business advisor is to look out for all possible hazards you could encounter while running your business. And to advise how to protect yourself, your company, and everyone else around you.

Let’s face it. We’re all going to die at some point. We humans don’t like to think about it, but it will happen. And because we put off thinking about dying, we can create a messy situation for the people we leave behind.

This article looks at what happens to a limited company if the founder dies and how you can leave shares in your will.

It’s all based on true-life situations I’ve come across with clients and friends, as you’ll see.

Let’s look at how this might end up for you.

Leaving shares in your will if you own 100% of the company

Most of the business owners I work with are the only shareholders in their company. And to be honest, they are the company – if the founder dies, the limited company is pretty much dead, too, as the founder is the one doing all the work.

But the limited company is the legal entity, almost a person in its own right. The company owns everything. You bought your computer through the company, the money is in the company bank account. And the limited company owns debts, including that Bounce Back Loan you’ve been paying off.

So even if you die, your limited company lives on as a separate legal entity.

What happens when you die, and your limited company is still going?

Two things can happen.

If you have made a will, the company goes to whomever you left it to in the will. If you haven’t made a will, then it goes to your closest relative. When you’re married, then it will normally go to your husband or wife, and if you’re not married, this could be a parent, a child or another relative.

There are a couple of points here.

Firstly, if you’re not married but live with your partner

I urge you to make a will and avoid a messy situation. You do not want to be in a situation where your partner expects to inherit your share of the house, your money and the limited company and then finds out that, actually, your mum inherits it all.

As Oliver Asha points out in the video, there is no such thing as common-law wife or husband in UK law. So if you are not married, your partner will not inherit anything at all, including your limited company.

Here’s Oliver Asha, CEO of Digilegal, talking about the messy situation that encouraged him to set up Make a Will Online.

Secondly, even if you are married, I urge you to make a will so that your wife or husband can easily fill out the forms to control the company and the bank account.

And if you intend your children to inherit the company (or one of them), do be clear about this in the will. Otherwise, it might not go to them.

Some business owners will make their partner (or child) a director of the company just to make this whole process easier. But remember that being a director is totally separate from owning any of the shares in a company, so this doesn’t automatically transfer ownership of the business. You need to make that clear in your will.

How I made a will in my lunch break

After I interviewed Oliver Asha about the interesting work he’s doing at Digilegal and Make a Will Online, I realised that my will was now out of date.

So my partner came round to the office for lunch and we spent about half an hour setting up mirror wills. It was so easy, all done. And £90 for both wills, including leaving our respective shares in the limited company.

When one shareholder of a limited company dies

What happens to your limited company if there is more than one shareholder and one of the shareholders dies?

If you have other shareholders, such as business partners, senior staff or even the whole team, you might not want your shares to be left in your will. Or you might not want your colleague’s shares to be left to someone outside the business in their wills.

Avoid this kind of messy situation

A few years ago, I was coaching a company where there were two directors. They owned the business 50:50 through a limited company. Let’s call them Stuart and Fraser.

Over the weekend, Stuart was killed in an accident. Completely out of the blue. He was only 36 and had a wife and young son. Horrible.

It turned out that his wife was going to inherit his share of the company as his next of kin. I never met her, but continued to support Fraser through all of this.

Of course, this situation was awful for everyone because of the tragedy of Stuart dying. That was bad enough. But the effect on the company was made much more difficult.

Poor Fraser had to continue running the company on his own while grieving. And while he managed to keep things going, over the coming months, he had a series of difficult conversations with Stuart’s widow.

He had to explain that Stuart’s salary couldn’t continue to be paid indefinitely because Stuart was no longer doing the work that made the money to pay that salary. And he had to ask her if she was willing to transfer the shares to him so that he could take over the company. She’d never worked in the company; it had all been Stuart’s, and she wasn’t interested in becoming a director.

You can imagine just how difficult those conversations were for everyone involved.

The company was a small consultancy and wasn’t worth that much. It would have been much easier in this situation if the owners had signed a shareholders agreement. This would have shown that they agreed that if either one of them died, their shares would revert to the company or to the other shareholder automatically. Ideally, Fraser and Stuart would have had a shareholders agreement and wills which would have both stated that the shares in the company automatically went to the other person.

Why a shareholders agreement is important

The shareholder’s agreement is important for lots of reasons, not just what happens to the shares if you die. It’s basically a list of all the things that can go wrong when you have more than one shareholder, and you work out in advance what you want to happen, should any of these issues come up.

I’ve written quite a few blogs about shares in small limited companies, and people often consult me about this. I often get people to promise me that they will get their shareholders agreement sorted out. And signed.

When you’re thinking about what would happen to your shares in a limited company after you die, the shareholders’ agreement takes precedence over your will.

Top tips for multiple shareholders in a limited company

- When you have more than one shareholder in your company, always have a shareholders agreement signed by everyone.

- And make a will as well

- Set up key person insurance so that if a director or shareholder becomes ill or dies, the insurance pays out to the company.

How Fraser and Stuart’s story could have been very different

If the co-founders Fraser and Stuart had put in place a shareholders agreement when one of the directors died, their shares would have automatically been transferred to the other director. Saving a lot of anguish.

And if they had set up key person insurance for both of the directors, this would have paid out a lump sum to the limited company when one of the directors died. That would have enabled Fraser to continue paying wages to Stuart’s wife for a lot longer than he was able to, which I’m pretty sure she would have appreciated a lot more than holding shares in the company.

This leads us to the question of…

Can shares be left in my will to my wife or children?

You can leave shares in a private limited company in your will. In fact, if you have a will and you don’t have a shareholders agreement, the shares will go automatically to the person who inherits from you.

Quite often, this means that your shares in your company will go to your husband or wife or to your children.

Fine, you think. They get the house, the car and the contents of my bank account; they should get the shares, too.

But should you leave the shares in your will?

If you own 100% of the shares, or you own the company with your husband or wife, then that’s probably a sensible idea. Unless your spouse is also your business partner, they will probably end up working with your accountant to close down the business and then with the executor of your will to be able to access the company bank accountant. [More on this in a moment.]

Let’s take Gary as an example

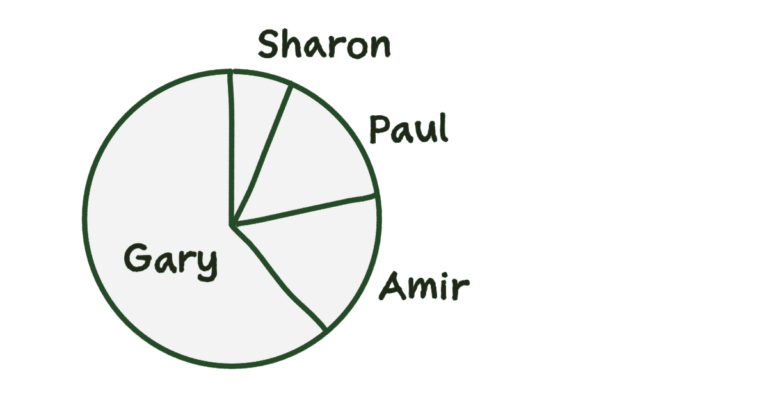

Gary set up a company in 2003. He gave shares to some other people along the way, 10% to his wife so she could draw dividends, 15% to a great salesperson who still works there and then another 15% to the person who Gary hopes will take over running the business when he retires.

Gary and the others have a shareholders’ agreement that sets out what happens to the shares in all kinds of different ways. Lawyers love thinking of these sorts of challenges, they put in clauses about what happens if someone leaves, if someone gets sacked, even if they go insane. And what should happen to the shares when someone dies.

Gary and the others have a shareholders’ agreement that sets out what happens to the shares in all kinds of different ways. Lawyers love thinking of these sorts of challenges, they put in clauses about what happens if someone leaves, if someone gets sacked, even if they go insane. And what should happen to the shares when someone dies.

In Gary’s case, everyone knows that if Sharon, Paul and Amir die, their shares go back to the company. And that if Gary dies, his shares go to Sharon (his wife).

When we were thinking about the shareholders agreement, Gary and I had a long discussion about whether Sharon should get the shares. She gets everything else in Gary’s will if he dies. However, there was a strong argument for either the shares to go back to the company or to be distributed between the other shareholders.

In Gary’s case, he felt that Sharon could continue being the majority shareholder because Amir would be able to carry on running the company, even if Gary was gone, and therefore Sharon could continue to get profits from the company.

What’s good about this solution for the shares in Gary’s limited company

I like this solution because

- Gary thought it through properly, including talking it over with me in one of my strategy sessions.

- He got all the paperwork set up

- He discussed it with everyone else before signing the paperwork

- They all signed their respective agreements

- It fitted his company’s circumstances. Maybe it wouldn’t have worked if Sharon wasn’t already a director who knew about the business or if Gary hadn’t already started to prepare Amir to take over as MD.

You can see that once you have more than one shareholder in your limited company, it becomes more tricky to work out what you want to happen when you die.

Talking this over with me

All of this is a big decision, and some people prefer to talk this over with an experienced business advisor. I regularly do one-off strategy sessions for people who have a big decision to make in their business, and they want to talk through their options.

Book a strategy session with Julia Chanteray

One final top tip

I got this one from a client running a high-end IFA business. He told me that he advised each of his clients to set up a folder for their partner or adult children covering all the practical details of what to do if the person died. Including what happens to your limited company if you die.

I set up my own version of this, and to this day, there’s a folder hidden in my friend’s house labelled “If Julia dies”. It has all the info on how to access my bank accounts and some secret passwords in a code only my partner would know. Plus, my will, my shareholder’s agreement, and practical instructions on what to do next. Including the playlist for my funeral.

Other useful articles

You might also find some of the other articles I’ve written about giving shares in your company away useful, especially if Gary’s story resonated with you.

To be self employed or a freelancer – what’s the difference?

And when you’re working hard on your business, keeping in mind the difference between being a space rocket and a donkey is always a good idea.

My favourite growth strategies for small businesses – are you following these?

Move on up – how to become a better business owner – based on years of practical experience and talking with hundreds of business owners.